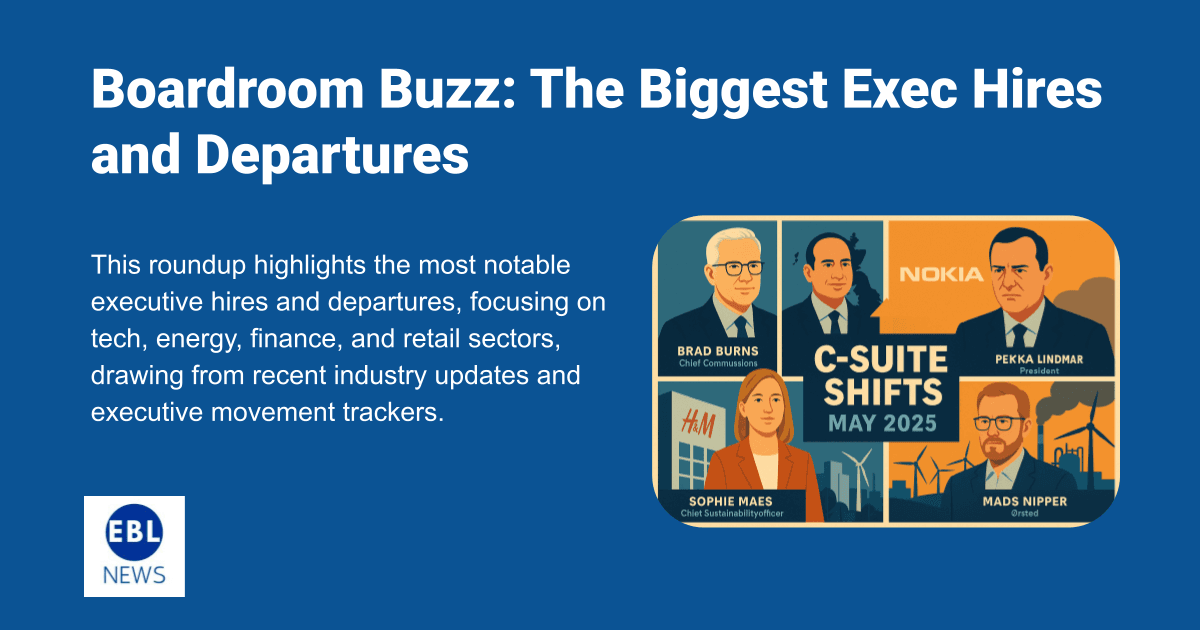

May 2025 has seen significant C-suite shifts across major European firms, reflecting strategic realignments in response to economic, technological, and regulatory changes. This roundup highlights the most notable executive hires and departures, focusing on tech, energy, finance, and retail sectors, drawing from recent industry updates and executive movement trackers.

Hires

Brad Burns, Chief Communications Officer, CrowdStrike (Tech, UK/USA)

Why It Matters: Burns, formerly Salesforce’s chief communications officer, joins CrowdStrike to lead global communications for the cybersecurity giant. His expertise in scaling tech brands will bolster CrowdStrike’s narrative as it expands in Europe, where cyber threats are a top boardroom priority (68% of directors cite cybersecurity as a key concern).

Jeetu Patel, President, Cisco (Tech, UK/USA)

Why It Matters: Patel’s promotion to president, announced by Cisco CEO Chuck Robbins, positions him to drive the company’s AI and networking strategy. His product-focused leadership is critical for Cisco’s European growth, where AI adoption is reshaping boardroom agendas.

Brooke Worden, SVP, Corporate Strategic Advisory, Padilla (Finance/Tech, UK)

Why It Matters: Worden joins Padilla’s corporate practice, bringing experience from financial and tech communications. Her role will strengthen Padilla’s advisory services for European clients navigating ESG and AI regulations.

Ryan Leach, VP of Investor Relations, Variant Investments (Finance, UK)

Why It Matters: Leach’s hire signals Variant’s push to deepen investor ties in Europe, where sustainable finance is a growing focus. His role will support capital strategy, a top board priority for 74% of directors.

Leyla Ertur, Chief Sustainability Officer, H&M (Retail, Sweden)

Why It Matters: Ertur joins to accelerate H&M’s goal of 100% sustainable materials by 2030. Her appointment aligns with rising boardroom focus on ESG reporting, with 43% of directors prioritizing sustainability in 2025.

Departures

Pekka Lundmark, CEO, Nokia (Tech, Finland)

Why It Matters: Lundmark’s exit after five years leaves Nokia at a crossroads as it navigates 5G and AI challenges. His departure, amid a 19% rise in CEO turnover in 2024, underscores the pressure on tech leaders to deliver immediate results.

Mads Nipper, CEO, Ørsted (Energy, Denmark)

Why It Matters: Nipper’s departure from the renewable energy leader comes as Ørsted faces supply chain issues and rising costs. His exit highlights the volatility in the energy sector, where boards are prioritizing resilience (61% cite sudden executive departures as a strategic risk).

Will Shu, CEO, Deliveroo (Retail/Tech, UK)

Why It Matters: Shu’s exit from the food delivery platform reflects challenges in scaling profitability amid regulatory scrutiny in Europe. Deliveroo’s board is now tasked with finding a leader to navigate a competitive market.

Stephen Bratspies, CEO, HanesBrands (Retail, UK/USA)

Why It Matters: Bratspies steps down as HanesBrands grapples with shifting consumer habits. His departure emphasizes the retail sector’s need for agile leadership, with succession planning a top boardroom priority in 2025.

Brad Corson, CEO, Imperial Oil (Energy, UK/Canada)

Why It Matters: Corson’s exit amid oil price fluctuations and Canada’s push for renewables signals a strategic pivot. European energy firms face similar pressures, with boards focusing on decarbonization and capital allocation.

Trends and Context

High Turnover: CEO departures in 2024 hit a record 1,800 globally, a 19% increase from 2023, driven by post-COVID recalibrations and demands for immediate results. Europe mirrors this trend, with tech and energy sectors seeing the most movement.

Succession Planning: 43% of directors rank CEO/C-suite succession as a top 2025 priority, spurred by the risk of sudden exits (69% cite it as a major strategic concern). Boards are investing in leadership pipelines to ensure stability.

AI and ESG Focus: New hires like Patel and Maes reflect boards’ emphasis on AI expertise and sustainability, with 41% of directors citing cybersecurity/AI risks and ESG as key trends.

Regulatory Pressures: Departures like Shu’s highlight Europe’s complex regulatory environment, where compliance costs and policy shifts (e.g., Trump’s trade policies) challenge executives.

Why It Matters

These shifts signal broader strategic pivots in European firms, from embracing AI and sustainability to addressing economic uncertainty. New leaders like Burns and Patel will drive innovation, while departures like Lundmark and Nipper underscore the need for robust succession plans. As boards navigate a volatile 2025, these moves will shape industry trajectories and investor confidence.